IDC Reports AR/VR Headset Market Up 18%

- Meta led the market rebound with a 50.8% share, while optical see-through (OST) claimed 22.5% of the market.

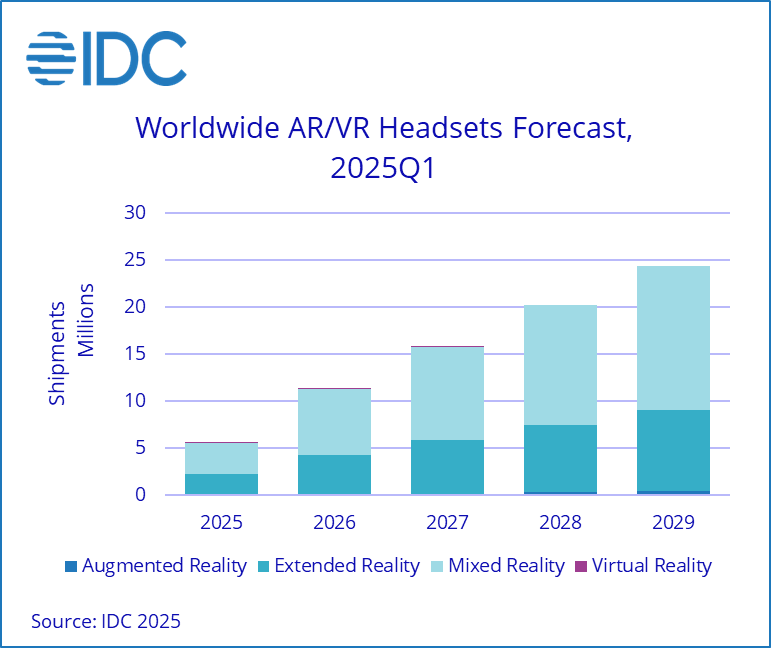

- Mixed and Extended Reality shipments are forecast to outpace pure VR, with ER set to quadruple by 2029.

According to IDC, the global AR/VR headset market grew 18.1% year-over-year in Q1 2025, driven by rising demand for Mixed Reality, Extended Reality, and optical-see-through (OST) devices. Meta led the market with a 50.8% share, followed by XREAL at 12.1% and ByteDance at 9.4%. TCL and Viture also saw notable gains.

“The market is clearly shifting toward more immersive and versatile experiences,” said Jitesh Ubrani, research manager for IDC’s Worldwide Mobile Device Trackers, in an official news release. “While Meta continues to lead, the rise of brands like Viture and XREAL shows that innovation in form factor and user experience is resonating with consumers. The next wave of growth will be driven by mixed and extended reality, especially as AI and Android XR platforms mature.”

This quarter marked a shift in the vendor landscape. Sony and Apple were absent from the top five. Meanwhile, three OST- focused brands, XREAL, Viture, and TCL, made up a combined 22.5% of the market, a first time for this category.

IDC forecasts strong growth in Mixed, Extended, and Augmented Reality, while shipments of pure VR headsets are expected to decline sharply. MR is projected to grow from 3.3 million units in 2025 to over 15.2 million by 2029, ER from 2.2 million to 8.6 million, and AR to 457,000 units. Despite a 12% decline in total shipments expected for 2025 due to delayed product launches, IDC projects a 87% rebound in 2026 and a compound annual growth rate of 38.6% through 2029, ultimately surpassing the pandemic-era peak.

“The worldwide AR/VR headset market is reaching a critical tipping point,” said Ramon T. Llamas, research director with IDC’s ARVR team, in an official news release. “Pure VR was once the darling of the market with companies like Meta, HTC, and Sony accounting for the vast majority of volumes. Now we have it on track to wind down in the next few years. Likewise, pure AR had strong promise with the help of Microsoft, but now we anticipate volumes to hold a small place in the overall market.”

🌀 Tom’s Take:

IDC’s data reinforces a clear market signal: VR is dead. That is, devices that only enable VR simulation are no longer the leader in the immersive interface race. The future belongs to hybrid devices that blend AR and VR, offering more than simulation alone. With AR functionality expanding across headsets and glasses, we’re clearly moving toward computing that enhances the real world, not escapes it.

Source: IDC